Your Ultimate Guide to Everything About CMFAS Exams

Your Ultimate Guide to Everything About CMFAS Exams

Your Ultimate Guide to Everything About CMFAS Exams

Meta description: Know why Capital Markets and Financial Advisory Services or CMFAS Exams are integral elements in the capital markets and financial services of Singapore.

General Overview of the CMFAS Exam

The Capital Markets and Financial Advisory Services or CMFAS Exams are licensing examinations intended to establish the integrity of Singapore’s capital markets. It is also intended for financial advisory services in Singapore. These exams are administered by the Institute of Banking and Finance (IBF) and the Singapore College of Insurance (SCI). IBF’s sole advocacy is to empower Singapore’s financial industry by developing competent and skilled practitioners to set the standard of excellence in Asia’s world of finance. On the other hand, SCI’s goal is to provide the highest quality professional training and education for the financial services industry.

IBF and SCI administer various examinations so future financial professionals may be able to have a good starting point in the capital market arena. One of the exams they conduct is the CMFAS. Basically, the CMFAS Exam is a modular type of examination that has just become effective on December 1, 2002. This is in compliance with several Notices issued by the Monetary Authority of Singapore (MAS) particularly under the SFA or the Securities and Futures Act and the FAA or the Financial Advisors Act.

What is the purpose of the CMFAS?

Since these are licensing examinations, it basically tests the general knowledge and understanding of the candidates of the following:

- The characteristics of each securities product. This also includes the techniques and the tools used in order to study and analyze the said product.

- The general regulatory framework of the capital market. This includes the laws and regulations that are covered under this scope. Furthermore, the guidelines, notices, and codes that govern not only the capital markets but also financial intermediaries are included here.

Note that once the candidates pass the CMFAS examinations, they are already considered eligible to apply for license as representative with MAS pursuant to SFA and FAA. Of course, the candidate’s application is still subject for approval by the MAS body.

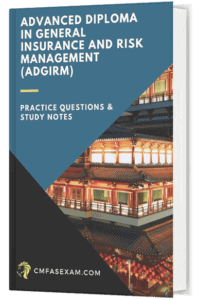

How many questions in the CMFAS RES examination and time allowed?

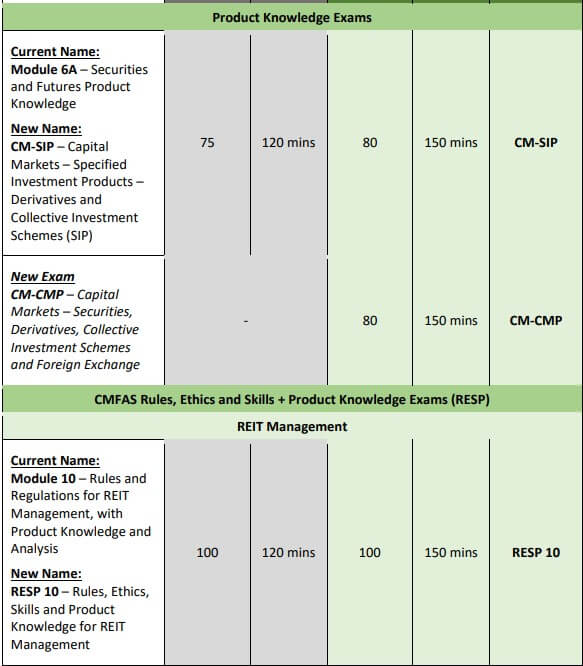

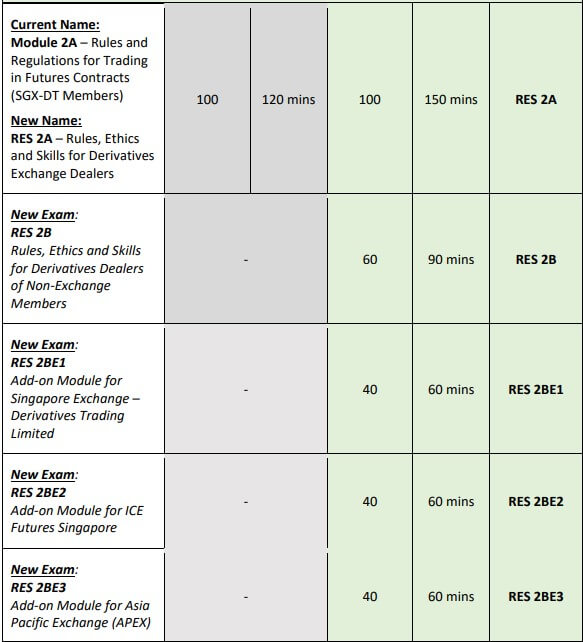

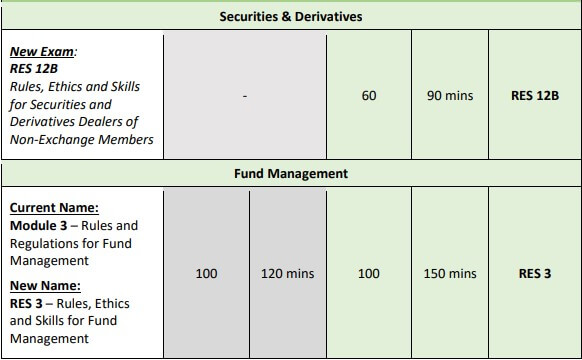

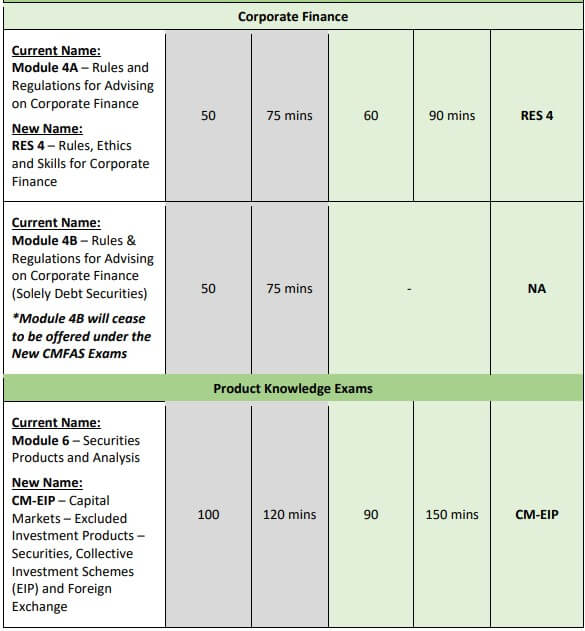

Please refer to below table issued by IBF:

The CMFAS Exam Modules for Rules and Regulations cover Module 1A, Module 1B, Module 2A, Module 2B, Module 3, Module 4A, Module 4B, Module 5, and Module 10. On the other hand, the CMFAS Exam modules that cover product knowledge and analysis include Module 6, Module 6A, Module 8, Module 8A, Module 9, and Module 9A.

Module 1A is for members of Singapore Exchange Securities Trading Limited while Module 1B is for non-members of Singapore Exchange Securities Trading Limited. On the other hand, Module 2A is for members of Singapore Exchange Derivatives Trading Limited while Module 2B is for members of the Singapore Mercantile Exchange.

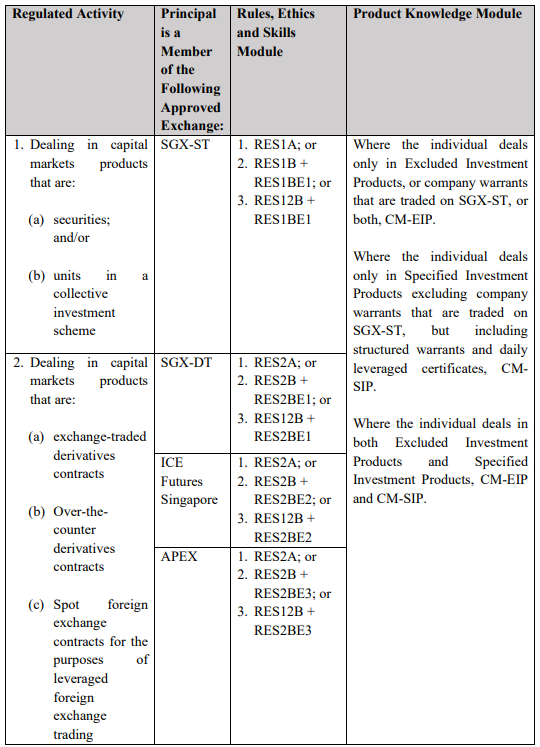

How should I know which exam module must I enroll in?

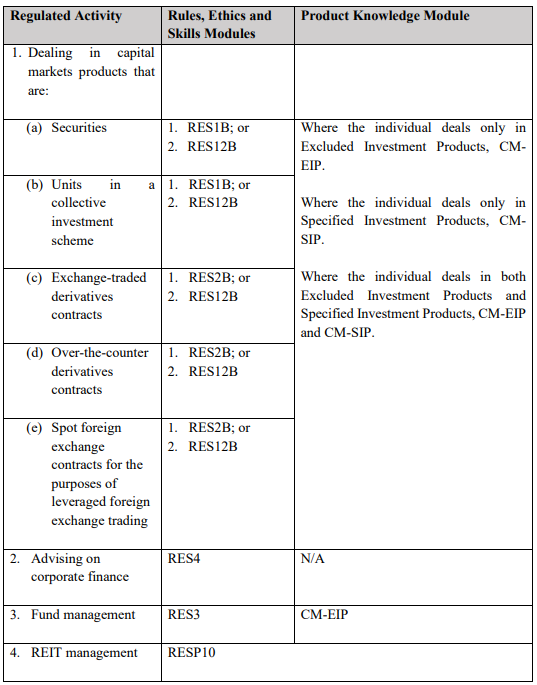

Given the number of modules available for the CMFAS exams, it can be quite complicated knowing which ones are we qualified or required to take depending on the nature of securities activity one would be exposed in. A detailed illustration for the said requirements is summarized here:

As illustrated, those candidates who wish to apply for a representative license on a particular regulated activity must make an effort to such exam module relevant to the regulated activity they are in.

Take note that the Modules listed on the table do not include Modules 8, 8A, 9, and 9A. The reason being is that Collective Investment Schemes, Collective Investment Schemes II, Life Insurance and Investment-Linked Policies, and Life Insurance and Investment0linked Policies II do not fall under the purview of a “regulated activity”.

Am I allowed to register for more than one examination all at the same time?

Yes, you are allowed to do so. You can register for multiple examinations within the same transaction on the IBF portal. However, this is different from registering for multiple exams within the same examination session as this is already prohibited.

Are there any minimum academic entry requirements for appointed representatives?

While it may be true that passing the relevant CMFAS exam is a must, the following are the required minimum academic qualifications for appointed representatives. Take note that these take effect starting February 1, 2014:

- a full certificate in GCE ‘A’ Level or General Certification of Education in the Advanced Level;

- an International Baccalaureate Diploma qualification;

- a diploma awarded by a polytechnic in Singapore; or

- any other academic qualification which is equivalent to the qualifications set out in a.), b.) or c.) above.

Where is the CMFAS Exam be held?

Unless otherwise provided, the CMFAS exams are usually held at the IBF Assessment Centre. Such examination venue is particularly located at 10 Shenton Way, #13-07/08 MAS Building, Singapore 079117.

How should I register for the CMFAS Exam?

Since it is both the SCI and IBF that administers the exam, it is important to know where to register depending on the module one is enrolling.

If one wishes to register any of the modules administered by the IBF, such registration may be done online via http://www.ibg.org.sg/examinations_services_registraton.asp. On the other hand, if one wishes to take any of the modules administered by SCI, one should reach out with the Examination Department from the SCI to know more about the registration details. One may also visit http://www.scicollege.org.sg

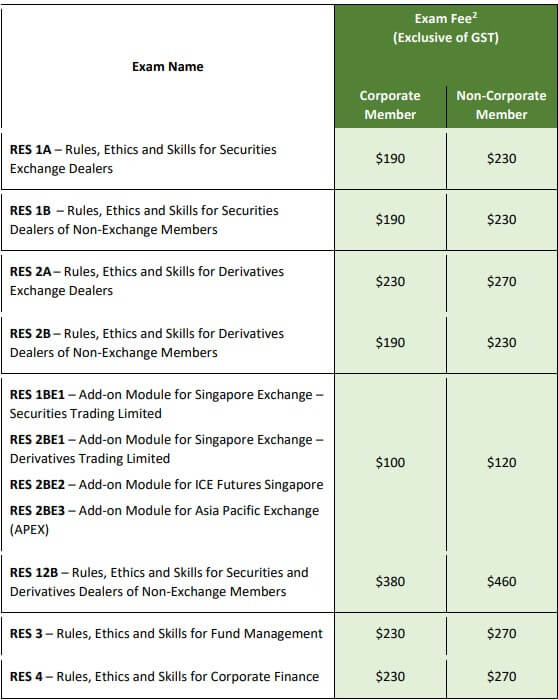

What is the Exam Registration Fee

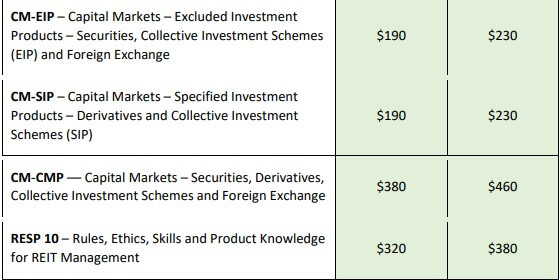

This table provides a summary of the exam fee:

Source:

Capital Markets and Financial Advisory Services

Implementation of New Capital Markets and Financial Advisory Services Examinations (CMFAS Exams)

Where can I get to purchase books or references for my study readings?

Candidates may be able to have access of their reference materials or Study Guides online immediately after they have successfully registered for the exam. However, for those candidates who would like to get hold of the hard copies of the Study Guides, they may do so by paying for an additional fee which is as follows:

- $20 + GST (Goods and Services Tax) for each copy for Modules 1A, 1B, 2A, 2B, 3, 4A, 4B, 6, and 6A

- $40 + GST (Goods and Services Tax) for each copy for Module 10

Take note that these fees are non-transferrable and non-refundable. Also, such rates may be subject change without prior notice.

Is it required to meet the requirements by my principal company even though I have complied the minimum requirements under Notice FAA-N13?

Yes. The Monetary Authority of Singapore or MAS puts the onus on the principal companies so they may satisfy themselves that their principals are fit, competent, and proper to work for them. In other words, these principal companies must make sure that before their hire their representatives, the representatives are rendered fit and proper to work based on their assessment before the principal companies appoint them as per guidelines set by FAA and SFA. For a representative to be considered fit and proper, he must possess integrity, competence and financial soundness.

While the fit and proper criteria is what is set out in MAS Guidelines as the minimum standards that representatives are expected to meet, still, the principal companies are encouraged to also set their own standards that are deemed higher than the minimum requirements as set forth by MAS.

Therefore, once your principal company requires you to take the relevant CMFAS exam despite having met the minimum required educational and work experience requirement, it can require you to take such exam in order to supplement your existing professional and educational qualification.

Am I exempted to take the CMFAS examination if I pass the professional or work experience qualification?

The FAA Notice on Minimum Entry and Examination Requirements for Representatives of Licensed Financial Advisers and Exempt Financial Advisers or Notice FAA-N13 stipulates that persons who possess certain particular qualifications or work experiences are thereby exempted from passing certain CMFAS examinations. These exams include certain Product Knowledge and Analysis modules.

However, if you intend to take CMFAS exam under the Rules and Regulations modules, note that there are no exemptions stated. It is required that you take it despite having met the relevant work experience and professional qualification.

What CMFAS exam module should persons who are about to make research reports about investment products have to pass?

Such persons fall under the purview of those who merely promulgate or issue investment reports and/or analysis. Thus, they are not required to take the CMFAS exam requirement.

Am I required to satisfy the CMFAS exam requirement if I intend to provide advice on both foreign exchange and leveraged foreign exchange.?

If you intend to provide advice on leveraged foreign exchange, then you have to satisfy the CMFAS Examination requirement- unless you are merely issuing or promulgating research reports, then you are not required to take the CMFAS exam requirement. However, if you intend to provide advice on foreign exchange only, there is no need for you to take the CMFAS Examination requirement.

Am I required to still pass the CMFAS examination if I am already employed with a financial advising company?

If you work with such company which, among others, issues report on investment products, except life policies, such stipulation falls under regulation 27(1)(d) of the Financial Advisers Regulations of 2002. As such the CMFAS Examination requirement does not apply to you.

Instead, the CMFAS Examination requirement only applies to persons who wish to provide financial advisory services for a licensed financial adviser or a person exempt from holding a financial adviser’s license.

Are the persons who provide advice on bonds to accreditors investors subject to the CMFAS Examination requirement?

- Persons who provide such advice are not bound by the CMFAS Examination requirement.

Are persons who are employed by any bank to provide advice on Singapore government’s securities required to take the CMFAS examination?

- Persons who are duty-bound by their employer bank to provide advice on the securities of the Singapore government are not subject to the CMFAS Examination requirement.

Is there a validity period for passing the CMFAS examination?

As long as you continue to be employed or connected with performing any regulated activity, you remain licensed to perform such regulated activities. However, if you have stopped within a period of 3 years and you did not comment in any regulated activity, then you are required to take the CMFAS Examination again for you to commence and carry out in performing any relevant financial advisory services that you have been performing before.

But there are certain qualifications and exemptions for this. For instance, prior to commencing the provisions stared for financial advisory services, persons should be required to re-take Module 5 and must pass it. But such persons are no longer required to take again and pass other CMFAS exam modules especially on Product Knowledge and Analysis. Now, if one wishes to provide advice on Specified Investment Products, then they are required to pass Module 6A, 8A or 9A. Of course, this should depend on the type of Specified Investment Product that you indent to render advice on.

Can an FA licensed representative continue the provision of financial advisory services if they left the company without completing the Module 5 non-examinable course?

Unfortunately, they are not allowed to continue on and take the non-examinable course should they wish to re-commence. However, this can be remedied as such person is required to pass the CMFAS Module 5 examination.

Will I be exempted from passing the CMFAS exam on the grounds that I am already an existing representative?

You are still required to pass the relevant product knowledge and analysis modules under the CMFAS Examination before you can commence the provision of new financial advisory services, unless there is no applicable CMFAS Examination requirement for the conduct of the additional financial advisory services.

What CMFAS Exam is required for those who want to provide securities and marketing advice on collective investment schemes?

The following CMFAS examination modules are required to be taken and passed. These are the Modules 5,6, and 8. In addition to these, if such representatives will be providing advice on securities and market, they are also required to pass Module 6A and 8A because such investment schemes are considered as Specified Investment Products; and because of that, they fall under the requirement as specified for Modules 6A and 8A. However, if they met the criteria as set out in Paragraph 18B of the FAA Notice on Minimum Entry and Examination Requirements of Licensed Financial Adviser and Exempt Financial Adviser under Notice FAA-N13, they are considered exempted from taking Modules 6A and 8A respectively.

What CMFAS Exam is required for those who intend to provide advice on life policies, including those investment-linked policies?

The following CMFAS examination modules are required to be taken and passed. These are the Modules 5,9, and 9A. However, on the other hand, they are exempted to pass particularly the Module 9A is they meet the requirements as set out in Paragraph 18B of the FAA Notice on Minimum Entry and Examination Requirements of Licensed Financial Adviser and Exempt Financial Adviser under Notice FAA-N13.

Do I have to pass Modules 6A, 8A, or 9A before I can expand my activities in providing financial advisory services?

Yes, an existing appointed representative must pass the relevant CMFAS Examination if he wishes to expand his scope of financial advisory services. However, he will be exempted from the requirement to pass Modules 6A, 8A or 9A if he meets the criteria set out in paragraph 18B of the FAA Notice on Minimum Entry and Examination Requirements for Representatives of Licensed Financial Adviser and Exempt Financial Adviser (Notice FAA-N13).

Should I be granted exemption from passing Module 6A if I’ve been appointed to provide services on Specified Investment Products prior to January 1, 2012?

Yes, an existing appointed representative must pass the relevant Module 6A if they intend to provide financial advisory services on Specified Investment products to non-accredited investors. However, they will be exempted from the requirement to pass Modules 6A if he meets the criteria set out in paragraph 18B of the FAA Notice on Minimum Entry and Examination Requirements for Representatives of Licensed Financial Adviser and Exempt Financial Adviser (Notice FAA-N13).

Final Thought

The CMFAS Examinations can be grueling and challenging. But like every unchartered territory, the only way to overcome such difficulties is to explore here. Hopefully, everything that has been presented here will provide you with enough knowledge and understanding about the dynamics entailed in CMFAS Examination. This will help you pass and even ace the exam.

Dario Ford

Dario is the Senior Customer Success Manager at CMFASExam